Frequently Asked Questions

- Is My Gift Tax Deductible?

- Yes. The American Legion is a non-profit organization qualified under Internal Revenue Code 501(C)(3). The Battlefield Memorial Gateway Committee is an official entity of the American Legion of Clinton County in Upstate New York. Donors are eligible to make tax-deductible contributions as provided in section 170 of the Internal Revenue Code. When requested, the committee will issue a letter for contributions. Please check with your financial advisor as everyone's situation is different.

- Who May Donate?

- Donations will generally be accepted from individuals, partnerships, corporations, foundations, government agencies, or other entities.

- Are Donations restricted in any way?

- Yes. Donations that do not fit the purpose of funding the park, whose maintenance costs outweigh its value, or have too many restrictions will not be accepted.

- My donation may be restricted. How do I proceed?

- Certain types of gifts must be reviewed prior to acceptance due to the special liabilities they may pose for Battlefield Memorial Gateway Committee. Examples of gifts that will be subject to review by the Sub-Committee include; gifts of real property, personal property, securities and trusts and gifts with specific restrictions. Please contact the committee at the address below for more information.

- Are anynomous donations accepted?

- Yes. We respect the right to make a donation privately.

- How are donations maintained by the Committee?

- The committee has established an account with TD Bank.

- Who is in charge of the Project?

- The Town of Plattsburgh and the Clinton County American Legion is behind the project.

- Who else is involved with or supporting the Project?

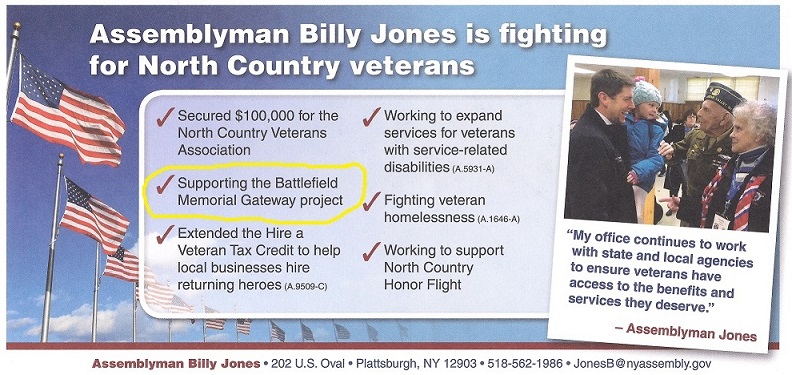

- Assemblyman Billy Jones has secured funding for the early stages of the project and he is working for additional project support.

|

Click on the TD Bank logo to access a secure TD Bank donation page. |

|

The Donate Button below will take you to a secure PayPal website. |